Welcome to Strategic Trading Academy: Perfecting the Art of Trading Psychology

At Funds and Galore, we’re excited to guide you on your journey to becoming a seasoned retail trader(Perfecting the art of trading).

Whether you’re new to trading or have some experience, you are welcome here. Our academy caters to all levels of traders.

We offer a comprehensive curriculum that covers both theory and practical lessons on our website and social media pages.

Beyond teaching you the skills to navigate the forex and stock markets, we will also host live streaming sessions featuring trading challenges.

These challenges are designed to encourage engagement and foster a learning community where we can all grow together.

Perfecting the Art of Trading Psychology

Before we get into the technical side of things, I would like to stress that it does not matter how good of a trader you are;

you will never be a profitable trader as long as you don’t have control over your emotions.

Psychology is the most important trait to have as a person wanting to harness well-calculated trades that align with a strategy that has stood the test of time.

Trading is Not a Get Rich Quick Scheme

My journey into trading began with a conversation with my friend Ethan in 2020. Though we hadn’t spoken in a while, our discussion quickly turned to the subject of trading.

I was intrigued when Ethan mentioned a former schoolmate (Thabo) who had found success in trading. Ethan’s encouragement prompted me to reach out to this individual.

Thabo’s words of wisdom, especially “NEVER GIVE UP,” left a lasting impression on me.

Never Give Up: Success Requires Patience

At F&G, we approach teaching differently from traditional education. We believe in embracing mistakes as opportunities for growth.

Through trial and error, we learn which habits to avoid and which to adopt. Think of trading like learning to skateboard.

Just as a beginner skater seeks guidance from experienced mentors, aspiring traders benefit from mentorship and perseverance.

Success in both fields requires focus and consistency. Motivation alone is meaningless without the dedication to see it through.

In trading, as in skating, progress comes from persistence and learning from missteps. It’s a journey marked by falls and failures,

but with each setback comes invaluable lessons that propel us forward. With patience and perseverance, success becomes attainable,

transforming beginners into seasoned professionals.

The Market is Not Your Friend

In mid-2020, I studied how Thabo traded and managed to move out of his parents’ house by the age of 17.

Despite his success, he even went on to finish school. I yearned for that kind of freedom. It amazed me that someone living a seemingly ordinary life could achieve so much.

As I registered this, I realized that the road to success takes time. Thabo told me it took him over three years of consistent learning.

My brother Ethan confirmed that Thabo always sat at the back of the class around 2017, minding his own business and trading.

Little did everyone know, the boy at the back of the class was just a few steps away from success.

Lesson Learned: Perfecting the Art of Trading Psychology

During this time, I managed to fund my first real account with $270.06 USD (R5,000). I knew nothing about risk management or the importance of having a mentor.

This is where things get interesting. Thabo, at that time, was working on creating a platform to educate people on how to trade.

He charged me $33.25 (R612) adjusted for inflation to join.

I eventually saved up enough to join, and oh boy, was I excited and ready to learn.

A few weeks passed, and the platform still wasn’t up.

Thabo was busy with exams, and while I understood that, my patience was wearing thin.

I was hungry to make money, dreaming about that BMW M4.

In my impatience, I made a fatal mistake that taught me a very valuable lesson.

Fatal Decision: Emotions Can Make or Break You

Thabo also had a signal group. A signal is a service provided by a professional trader, where they tell you when to buy or sell shares or currencies at what they believe is the right time to enter a trade.

In the heat of the moment, I asked Thabo to put me in his signal group instead of his mentorship package. Unfortunately for me, he agreed.

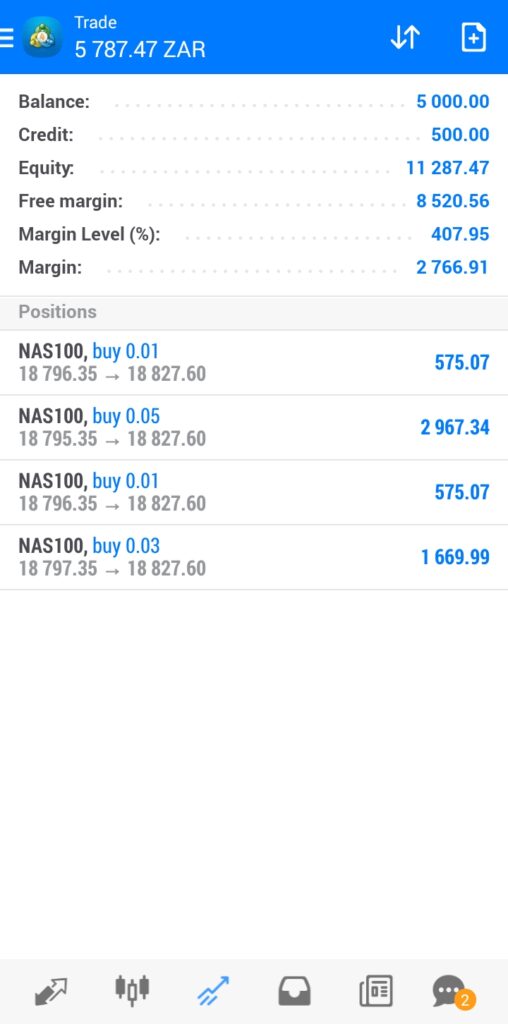

My goal was to mimic Thabo’s trades exactly. For example, Thabo would open five positions with a lot size of 0.01 (don’t worry, I’ll explain the lingo as time goes on for those who don’t understand)

for Nasdaq with a $271.48 (R5,000) account. He was over-leveraging his positions,

meaning that when he won, he stood to make over $1,086 (R20,000), and when he was wrong, he only lost the $271.48.

I wanted to do the same thing but didn’t understand that Thabo, unlike me, could easily fund another $271.48 if his trades didn’t go as planned.

It took me a long time to gather the $271.48 to fund my account, and I certainly didn’t have another $271 if my trade went south.

Impatience got the better of me as I waited for Thabo to send us another signal. After the first day without any communication,

I started looking for trades on my own, thinking Thabo was too busy to check the market, not realizing that good trades take time to develop.

All I understood was that you buy from the bottom and sell at the top. So when I opened my MetaTrader 4 app and saw the Nasdaq chart with candlesticks appearing at the bottom,

I, along with my cousin and little sister (my trading buddies at the time), concluded that I should buy. I opened a 0.03 and a 0.01 lot size to test the waters.

You wouldn’t believe what happened next. A few minutes later, Thabo sent a buy signal.

We went crazy and started entering 0.05, 0.02, and 0.01 lot sizes. Within three minutes, my account flipped from $271.48 to $978.22 (R18,000)

adjusted for inflation. Never had I thought I’d make so much money in such a short period of time; this was when my love for the game started.

As exciting as it was, little did I realize the risk I had taken. I opened a total of 12 positions with a $271.48 (R5,000) account,

which was extremely risky. Lucky for me, Nasdaq prices soared without any market retracements.

In my excitement, I sent Thabo my results. I bet he thought, “Wow, this guy is crazy, so many positions without proper risk management.”

A few moments later, he sent us another signal to buy US30, and this is where my greed took full swing.

Keep in mind that the signals we received didn’t include a stop loss or take profit price level.

A stop loss is an order placed with your broker to sell at a specific price level to protect against large losses, and a take profit is an order to sell at a specific profit target.

Without these safety nets, I aimed to convert our new account balance of $978 to $2,714 (R50,000) with the US30 signal from Thabo.

I did exactly what I did with Nasdaq, but this time, the market sold instead of buying. In just under two minutes, I watched my account plummet from $978 to $37.99.

I couldn’t sleep that whole night. This was one of the hardest things to digest at the time. The market taught me a valuable lesson: Forex is not a get-rich-quick scheme.

End of Part 1: Perfecting the Art of Trading

As we continue this journey, I hope you now see the critical importance of having proper risk management if you want to survive long-term in the forex market.

Mimicking a professional trader’s style without proper guidance is a recipe for disaster.

As we just saw, I ended up losing the majority of my account all in one day. This was a lesson well learned because today,

I trade with proper risk management. Instead of flipping my whole account in one day,

it might take me a month or so to double it because I understand the value of risk management and patience.

At F&G Company, we are here to ensure you don’t make the same mistakes I did. Our goal is to provide you with the tools and knowledge to trade responsibly and successfully.

Through our comprehensive curriculum, live trading challenges, and a supportive community,

we aim to build not just skilled traders but disciplined ones who understand the art of trading psychology.

Stay with us as we dwell deeper into the strategies and mind-sets that lead to sustainable success in the trading world.

Together, we will navigate the highs and lows of the market, turning each challenge into a stepping stone toward mastery.

Welcome to Strategic Trading Academy, where your journey to mastering the art of trading psychology begins.

[…] I offer a Free Strategic Indices training […]