Have you ever felt drained when the market doesn’t follow your price action setups? Or are you looking for guidance as a beginner trader? Well, you’re in luck! Today I’m going to show you the only Trading View indicators you’ll ever need.

These five AI-powered Trading View indicators will help you trade

like a professional and even assist in developing your own trading style.

Eventually, you won’t need them anymore, because by then, you’ll understand how price action works.

The Only Trading View Indicators You’ll Ever Need: Misunderstanding of the Game

Price action trading or trendline trading is one of the most used trading strategies worldwide.

However, many traders abandon this simple strategy because they claim their setups don’t work.

For example:

You buy at support, but the market sells. You sell at resistance, but the market buys.

You enter a breakout, and the market reverses.

This leads many traders to underestimate price action and jump from one strategy to another without solving the real issue.

The truth is, 90% of the time, the problem is not the strategy—it’s the lack of skill.

Markets, no matter what you’re trading, include manipulation.

While beginners may feel misled, pro traders see high-probability setups.

It’s not the market that’s flawed; it’s often your inability to properly identify trends, support, resistance, and key levels.

Don’t worry—we’re going to dive into how to learn this faster and with more precision using the right tools.

The Only Trading View Indicators You’ll Ever Need: Importance of Indicators

When I began my trading journey, I tried many tools—even trading robots—but what

truly accelerated my progress were indicators.

Over time, I learned to trade price action without them.

However, indicators can save you months or even years of learning.

This blog is meant to shorten your learning curve without skipping the necessary process.

These indicators support every type of price action trader: scalpers, swing traders, or day traders.

All you need to do is apply them to your style and grow from there.

Remember, knowledge is power, and shortcuts often lead to setbacks.

Let’s explore the only Trading View indicators you’ll ever need that can build an edge for both beginner and advanced traders.

1. Trend Navigator

This indicator helps traders identify market trends.

One common issue with many traders I coach is their inability to draw or adjust trendlines properly.

This stunts their growth because they don’t even realize their mistakes.

The Trend Navigator allows you to compare your analysis with AI-generated trends, helping you

spot where you went wrong and how to improve.

It helps detect bullish and bearish trends and shows you where to exit your positions.

2. Support and Resistance Matrix

This powerful tool identifies demand and supply zones—areas where traders typically buy or sell.

While trendlines alone are not enough, combining them

with support and resistance gives you high-probability trade setups.

These VIP indicators help you understand how to merge key principles to sharpen your trading edge.

3. Market Scanner

The Market Scanner adapts to your trading style.

You can customize it for forex, indices, metals, or any market you prefer.

As Warren Buffett advises: “Only invest in what you understand.”

The same applies to trading. Focus on what you know.

Once you identify your preferred pairs or instruments, this tool allows you to set alerts—such as

when a bullish engulfing pattern forms, RSI drops below 30, or price moves above the 200 MA.

It simplifies your trading process by automatically meeting your entry conditions.

It’s suitable for both day and swing traders.

4. Oscillator

Being able to identify overbought or oversold conditions is essential in price action.

I often highlight this in my market breakdowns on YouTube.

Oscillators help identify reversal zones:

-When overbought → look for sell opportunities.

-When oversold → look for buy opportunities.

-The most common oscillators include:

Relative Strength Index (RSI): Measures price momentum. Above 70 = overbought; below 30 = oversold.

MACD (Moving Average Convergence Divergence): Measures trend momentum across timeframes.

It was my favourite tool when learning about momentum.

The Shortcut Smart Traders Use to Master Price Action

If you’ve made it this far—congratulations!

You now understand why traders struggle with trends, support, resistance, and entries.

But what if you could master all this quicker, without gambling or spending all day on charts?

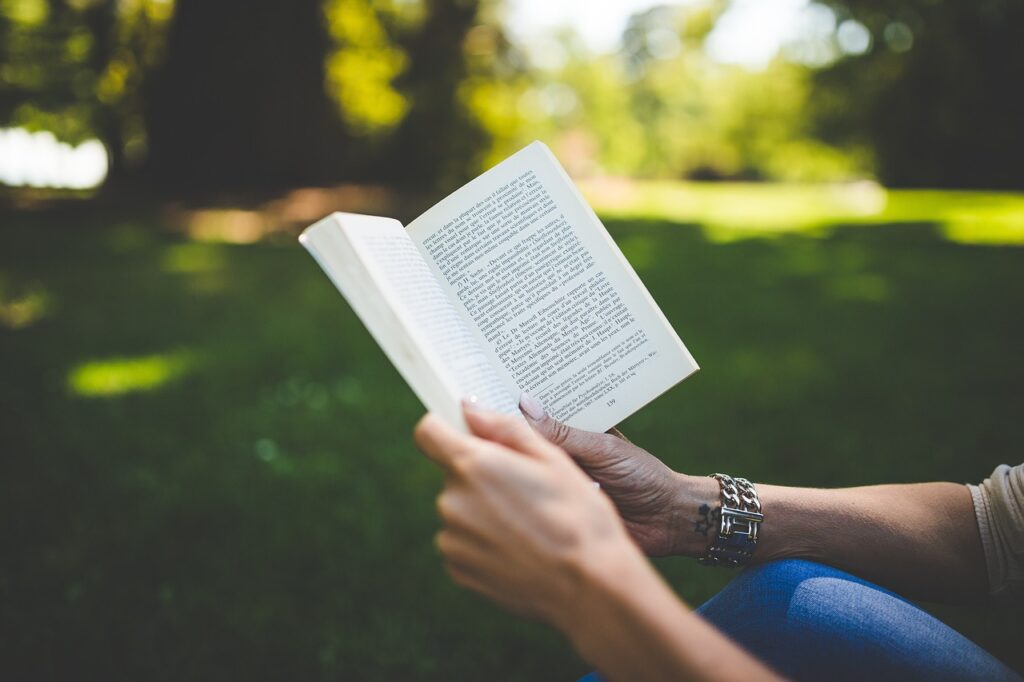

Get 24/7 Access to 5+ Powerful VIP Trading Indicators

These VIP Trading View indicators are ideal for price action or trendline traders ready to level up their game.

They offer clarity, precision, and live signal alerts.

Not only will you receive live alerts, but you’ll also learn to spot trends, key levels, and momentum independently—on any timeframe.

What You’ll Unlock

With these tools, you’ll gain:

- 24/7 access to all five indicators.

- The ability to distinguish high-probability from low-probability trades.

- Compatibility with any market: forex, indices, oil, stocks, metals, etc.

- Usage across all devices—PCs, smartphones—and from any country.

- 24/7 support.

If you’re serious about mastering price action and fast-tracking your education, this is the edge you need.

[Click here to get 24/7 access to VIP TradingView Indicators now.]

The Only Trading View Indicators You’ll Ever Need: Conclusion

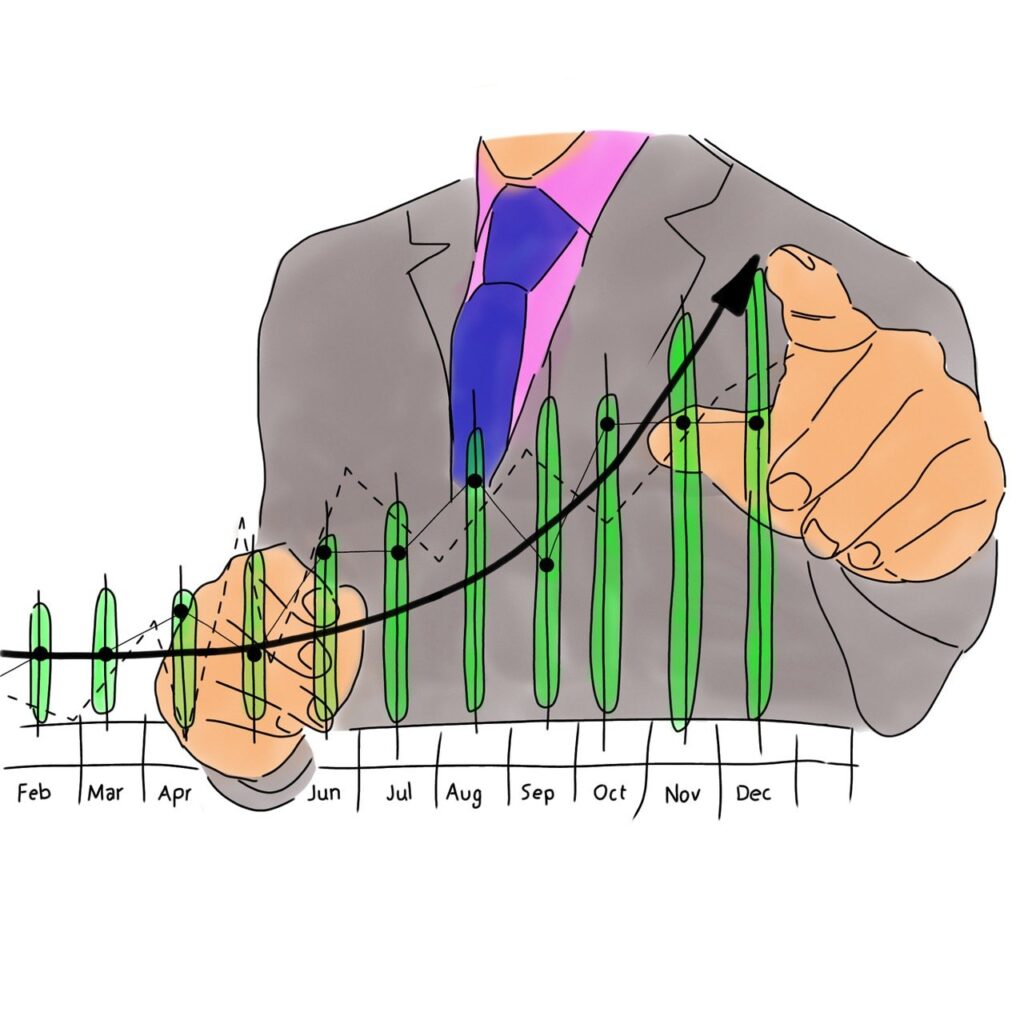

Mastering price action takes time, but the right tools can dramatically shorten the learning curve.

These five essential Trading View indicators are all you need

to identify trends, find support/resistance zones, scan the market, and pinpoint overbought/oversold areas.

They’re especially valuable for beginners or traders seeking more consistency.

If you’re serious about developing a winning edge and understanding market structure with precision, these indicators

are the best shortcut you can take—without sacrificing quality learning