Forex Strategy for South Africans

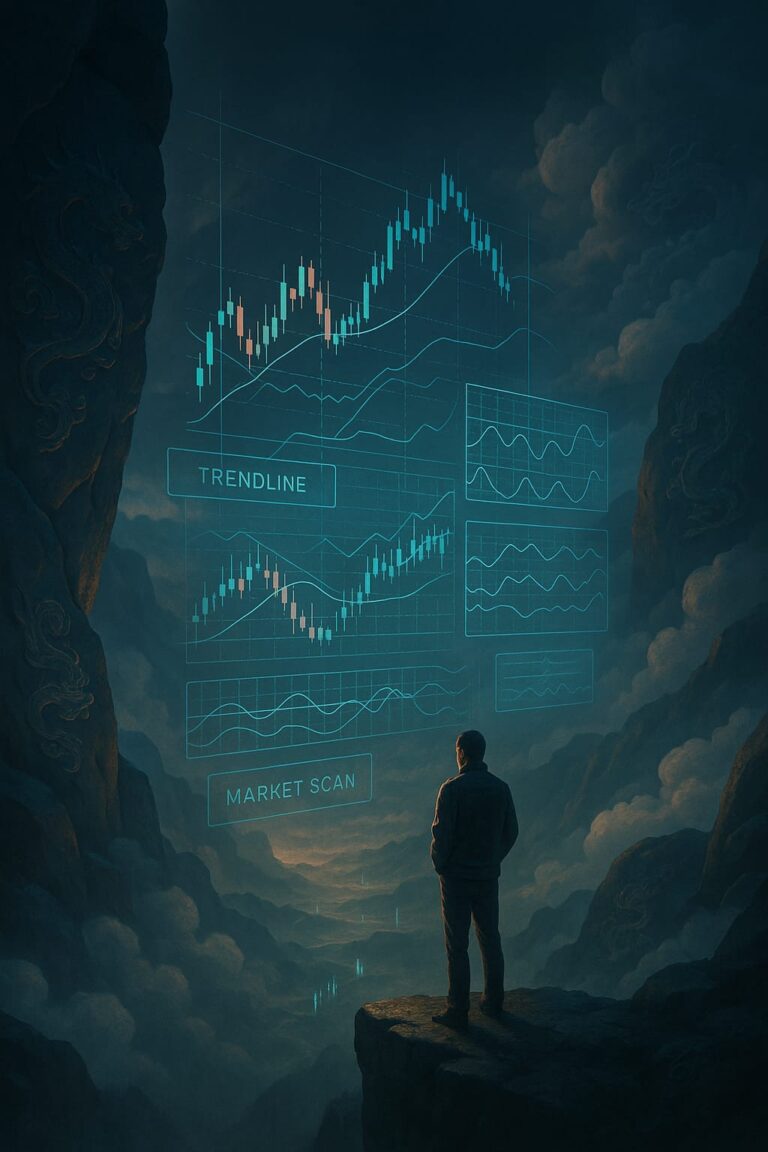

The Strategy: Forex Strategy for South Africans Forex Strategy for South Africans: Before we get to the strategy, there are a few aspects of trading you need to know. We will discuss trading edge, entry and exit strategies. I can…