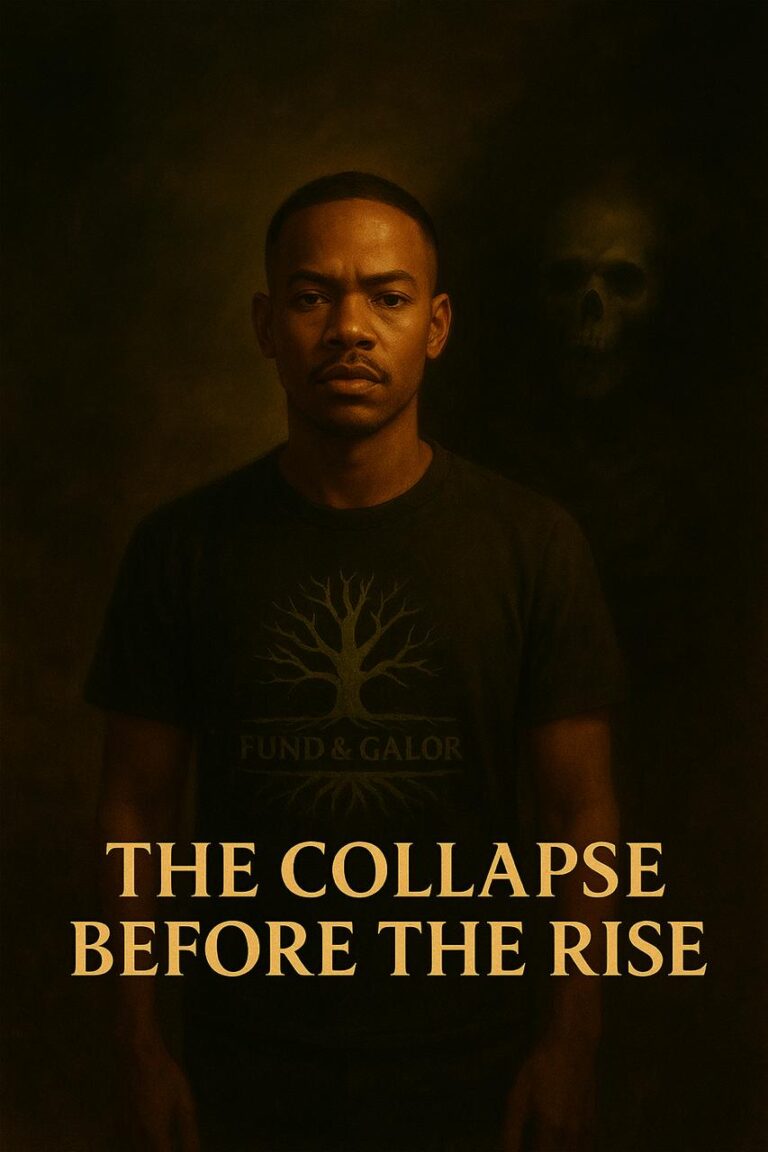

The Collapse Before the Rise: Surviving Chaos

Chaos is not the enemy of life, but the engine that ensures survival.The collapse before the rise is like your last matric exam:a test many traders fail every day, month, and year. Not from weakness, but from the internal war…