FINANCIAL BUBBLE : Inflation Part 1

Inflation is something we all feel because it affects every one of us. The thing about inflation driven price increases

is that if you are not prepared for it, it can wipe you out in the long run.

Over the years, we’ve seen inflation rise through the roof, whether it’s through petrol prices, food commodities, or interest rates.

So it boils down to one thing:

what is inflation? How can I make sure I don’t fall behind? What causes prices to rise? I’ll explain everything you need to know

about inflation and how governments can lead their nation’s economy into hyperinflation.

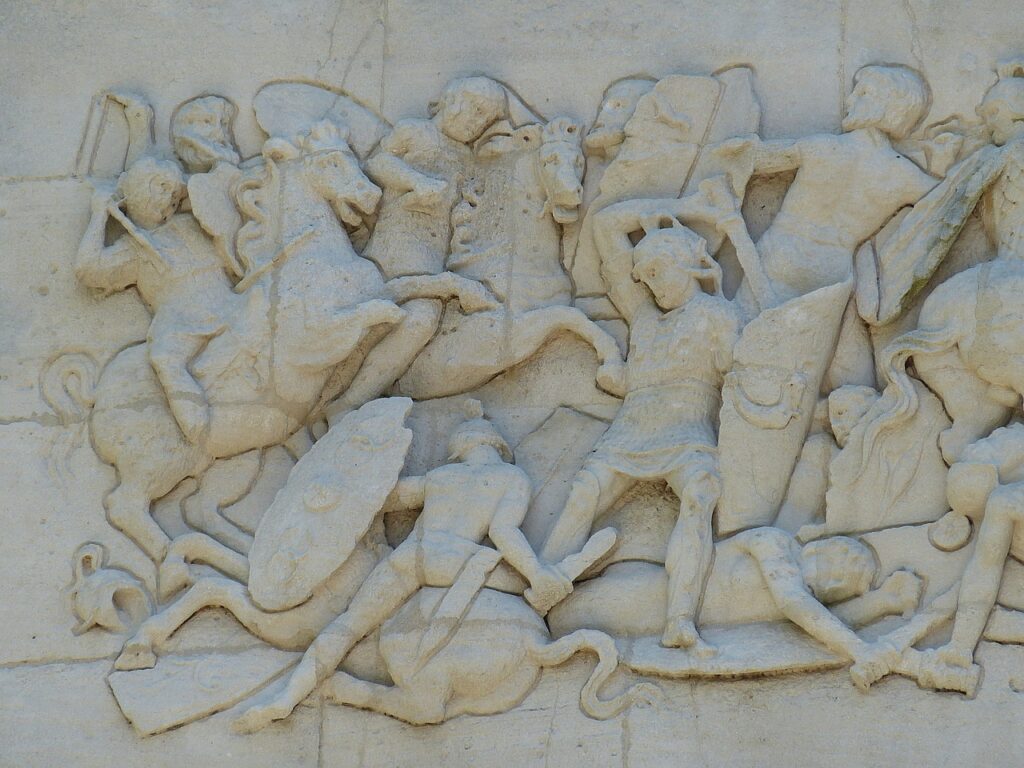

Rome’s Collapse and Modern Inflation: A Warning from History

To understand how inflation gets out of control, let’s dive back into history so that I can point out the events that led to the collapse

of the economy of Rome and what central banks of today are doing that is similar to Rome, which also led to their economies to collapse.

Inflation occurs when there is more money supply than there are goods and services produced. There needs to be a balance between

the money supply and goods and services to maintain the system. The more money that circulates in an economy, the more worthless it becomes.

In the early years of the Roman Republic (around 178 years), there weren’t any signs hinting that there was inflation during the time.

The fact that they were using gold and silver coins as their currency was the reason inflation was under control. In the early 218 BC,

Rome went to War with Carthage, leading to the Second Punic War.

By this time, the Romans needed money to fund a war so they needed to find a way to solve this problem.

It was either to cut payments to soldiers, which could be dangerous because it can result in them taking unpredictable measures, or they could increase their money supply.

They increased the money supply. What they did was deficit spending (creating more money) by melting the coins (gold and silver)

they took through taxation and adding more cheap base metals like copper to create more coins (decreasing the purity of their coinage), increasing their money supply.

This caused inflation and also caused the purchasing power of Romans to decrease because the new coins they made

had contained less gold and silver and more copper and bronze, making it less desirable to trade with.

Rome’s Coin Clipping Scheme and Its Collapse

As the Romans continued to debase their currency (lowering the value of a currency),

they began coming up with loopholes to increase their money supply.

One of the ways was through coin clipping: which means cutting off a piece of a precious metal coin like silver.

By gathering enough, you would be able to create a new coin.

What the Roman government did was to cut off the edge of a coin whenever a Roman citizen would enter a government building,

save those clipped-out coins, and create new coins, expanding the money supply. With more coins in circulation, this gave the government the power to spend more.

This addictive habit of increasing the money supply that continued to expand and expand can only lead to disaster.

The consequences of the decisions that the Roman officials took didn’t happen immediately; it took time to mold.

These unprecedented actions were the reason wealth was robbed from the citizens of Rome because their purchasing power decreased due to price increases.

This would eventually lead to occasions whereby soldiers would protest demanding an increase in wages due to the worthlessness of their coins.

Eventually, prices of goods and services started raising rapidly, and the government also started increasing taxes on the citizens

to try to control the situation, but this failed.

Eventually, the bubble burst, and Rome was hit by hyperinflation, which wiped out the middle class and the poor people

and also affected the wealth and lifestyle of the affluent.

For example, there was a time when 1 pound of Gold = 50,000 Denarii (Roman currency); around 50 years later,

1 pound of Gold = 1,200,000,000,000 Denarii (42,400% hyperinflation).

To explain this hyperinflation, I will use the USA and South Africa. A VW Golf 7R car = R695,000 with a 42,400% hyperinflation,

the same car would cost R295,336,000. A loaf of Albany bread = R20; with a 42,400% hyperinflation, you would have to pay R8,480 for a loaf of bread.

If your dream house costs $387,000 with 42,400% hyperinflation, you would have to pay $164,088,800 for the same house.

This is how the Roman Elites stole the purchasing power of its people and eventually collapsed its financial system.

Rome: How Inflation Shapes Our World Today

According to Britannica Money.com, today’s monetary system is backed by nothing besides governments’ promises.

Currencies that are in circulation globally, whether it’s Euro, Pounds, Rands, or Dollars, are called fiat currency.

The existence of fiat currency came after former US President Nixon took the dollar out of the gold standard in 1971.

This is the same thing Rome did when they debased their currency, by increasing their money supply.

The Romans took out the intrinsic value out of their currency by adding copper in gold and silver to increase the money supply.

US President Nixon took out the intrinsic value out of the dollar by removing it from the gold standard.

The problem with government is that they like to say one thing and end up doing another.

President Nixon stated that the suspension of convertibility of the dollar to gold would be a temporary thing that will be in motion for only 90 days.

Today marks the 53rd year since Nixon removed the dollar from the gold standard.

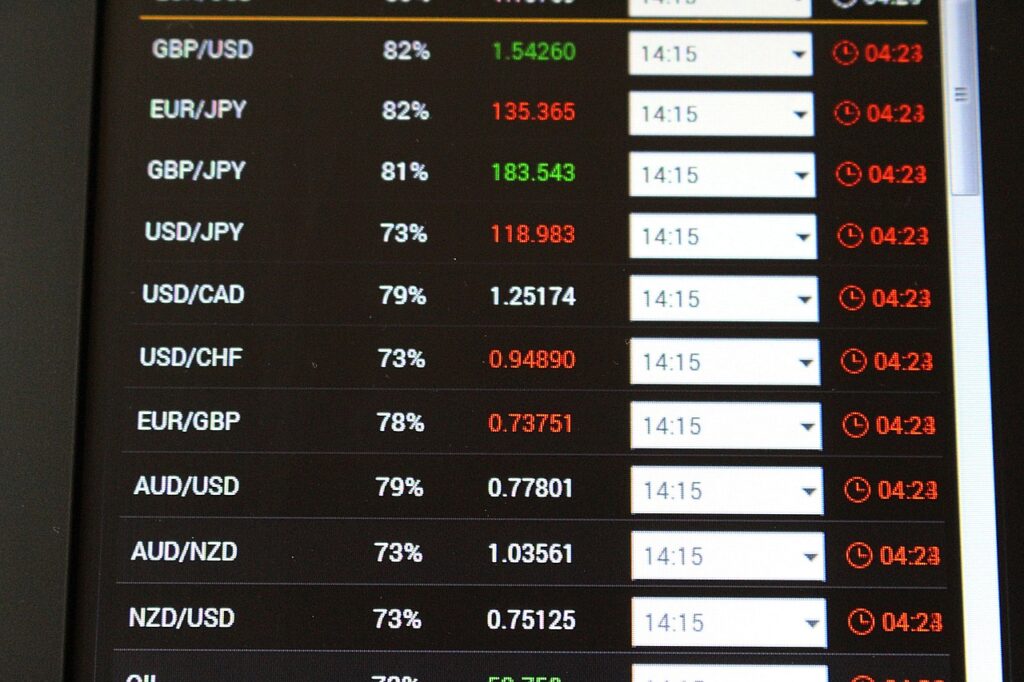

If you want to know the value of your local currency today, you would need to measure its relation with another country’s currency most preferably the dollar.

A country with a good economy typically has a more dominant currency than a country that is suffering from economic instability or inflation rates.

(we will be able to see the relation in currencies once we get into technical analysis when trading the forex market).

In today’s economy foreign central banks have procedures in place to be flexible to adjust with the fluctuations of the dollar

because like I said every foreign currency is measured against the dollar.

One of the key things to keep in mind is that if the American financial economy collapses, it will affect every country around the world, especially the US country.

Let me explain why. I agree with blockworks.co This monetary system is built up like a Ponzi scheme.

Before you attack me, allow me to explain how so. A Ponzi scheme is basically the continuous efforts of gathering

bigger and bigger pools of investors to pay off previous investors.

For example, Jane convinces investor 1 to invest $500 and promises to give him a 70% interest,

then Jane gets investor 2 and convinces her to invest $1,000 and promises to pay 70% interest.

With Investor 2 money, Jane uses it to pay investor one’s initial investment plus 70% interest, which would be $350 (interest), then she will keep the rest.

Then eventually, she will have to find another investor to pay off investor 2 plus interest, and so on and so on

until eventually it comes a day where Jane won’t be able to find new investors and the bubble collapses

or when it comes a day whereby all investors want to cash out at the same time.

Before I show you the similarities (covered in part 2: Inflation Driven Prices) let me explain briefly these 2 departments

so that you can understand broadly my comparison. The US Federal Reserve, also known as the Feds, is the central Bank of America.

The Feds are responsible for how much money is circulating in the economy that is ready to be spent on goods and services,

this is known as monetary policy. This gives the Feds the power to control interest rates and the state of health of an economy.

The Department of Treasury is responsible for fiscal policy. Fiscal policy is basically the use of taxation and government spending to influence the economy.

End Part 1: Inflation Driven-Price Increases

Rome was one of the most stable cities in the Mediterranean before the outbreak of the second Punic War. The war tested too much for Rome financially.

Their financial situation was so bad that they did not have enough reserves in their treasury.

This resulted in the Roman official to take action by debasing their currency much like what United States central banks did in 2008

to prevent America’s biggest banks from almost collapsing the global financial system.

Yes, I will also be discussing the 2008 crisis, but not in the series of Inflation, I will cover on a different article so stay tuned.

So to continue- Rome not being able to finance the war started the early practices of “printing money”

debasing their currency to increase the money supply which eventually caused high records of inflation.

By identifying the root problem to the collapse of the Roman empire we can see the same that is been done today.

Inflation we experience it year in year out never once have you had the price of bread for example went down from $5 to $2

but you are accustomed to hearing, “Wow I don’t think I will be able to make my groceries this month the way prices are so expensive”

or “sorry darling mummy cannot afford to buy your favourite meal at Mac Donald’s anymore.

In the present day, it holds significance for individuals to grasp the concept of inflation and strategies

for safeguarding their wealth against erosion of its purchasing power.

Fortunately, you’ve landed in the right spot. Here at Funds and Galore, we are committed to enlightening our eager community about various methods to shield their wealth.

It’s crucial to bear in mind the timeless wisdom often echoed by economists such as Milton Friedman:

the persistent presence of inflation whenever there’s an excess of money pursuing the same pool of goods and services.