Banking Through the Ages

A few years ago, as I was growing up, I often wondered how banking through the ages Part 2: had evolved to the point where modern banks made so much money

especially while I was waiting in line to withdraw cash from an ATM.

The most common answer I received was that banks kept large vaults filled with depositors’ physical money

and that this money was then lent out to other clients, allowing banks to profit from the interest charged on those loans.

To a degree, this explanation holds some truth.

Now, allow me to give you a more detailed breakdown of how

modern banks were formed and how they later played a role in the financial crisis of 2007–2008.

In the last article, we explored the origins of banking through the ages.

If you haven’t read Part 1 of “Banking Through the Ages,” I encourage you to begin there, either before or after reading this piece. Thank you.

The First Form of money: Banking Through the Ages part 2

Banking Through the Ages part 2: The first form of money is created by the government. There is about 3% of this form of money (notes and coins) created through the central bank.

So basically, this physical money (3%) is sold to banks. For example, it roughly costs the central bank about 3 cents to print a $10 currency note.

The central bank then sells this $10 note to a bank at face value.

Banks can either buy this $10 or repay it back at a later stage. Banks then can finally use this physical money to meet their obligations,

like making sure they have enough money to meet the daily withdrawals of individuals belonging to that bank.

So now we understand where the money we withdraw on a day-to-day basis comes from.

Now the question is if it costs the central bank 3 cents to create a $10 note, what does it do with the $9.97 profit?

Well, the central bank uses this profit to add to the tax revenue of the government.

This is known as seigniorage. Seigniorage helps reduce taxes that we, as people, pay and also helps reduce government debt.

Private Banks (Fiat Currency)

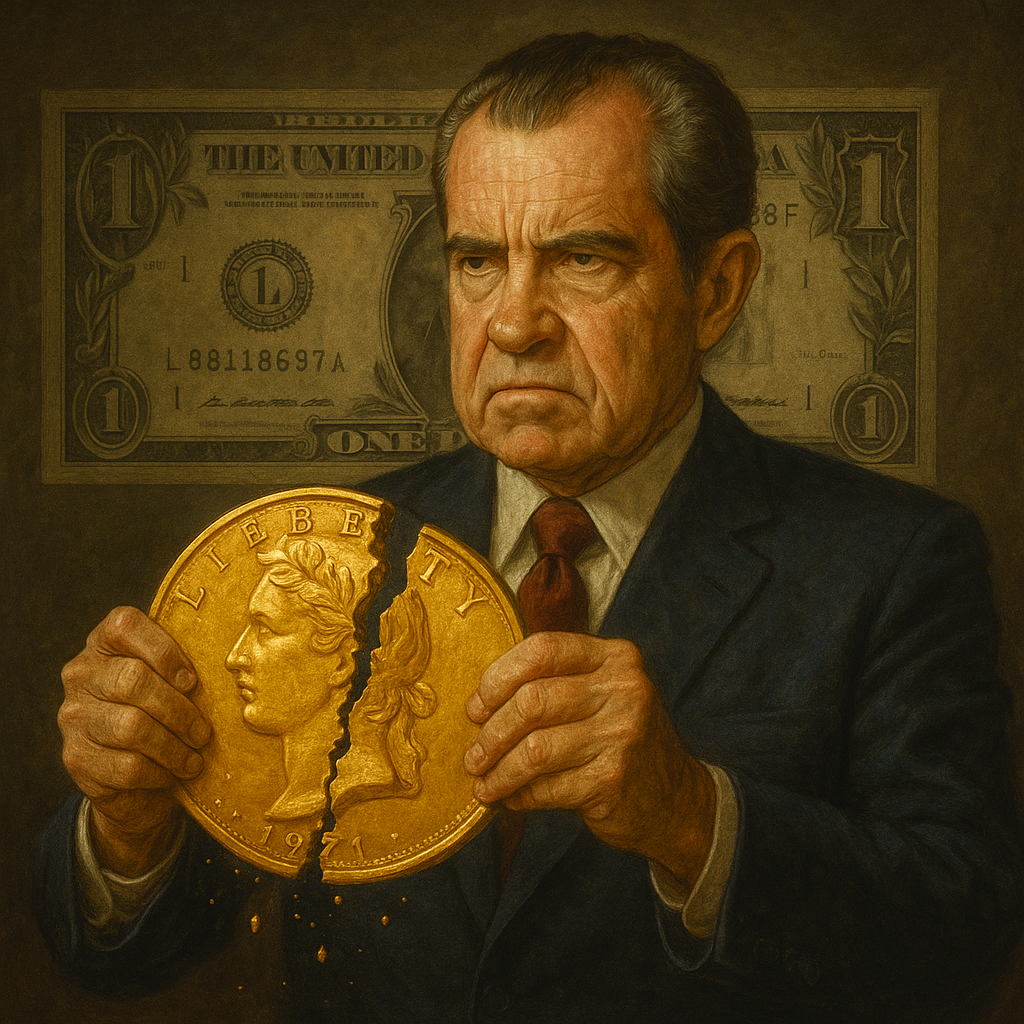

Fiat currency is money that is backed by nothing, it does not have intrinsic value.

1971 former president Nixon put an end to the Bretton wood system and all currencies became fiat.

When we look back in the 17century remember goldsmiths issued out receipts in exchange for gold coins

and these receipts were as good as gold because people believed it had value, so they continued to trade with it.

The same thing with us today. Fiat currency’s value is largely based on the public’s faith in the currency’s issuer(government).

In most developed countries, 97% of money is created digitally by the private banking sector,

even the 16th Chair of the federal reserve of the United States Jerome Powell mentioned in an interview that the fed prints the money digitally.

The reason for this is that banks have been exposed to bank runs many years ago.

A bank run is an occurrence whereby a lot of depositors simultaneously withdraw their deposits from a bank in fear of the bank being insolvent (not able to repay its depositors).

Remember in my previous article “Banking Through the Ages”, I mentioned: back in the 17thcentury goldsmiths would give out receipts (notes) to borrowers.

The receipt details that the borrower promises to pay back the principle plus interest.

Goldsmiths would write out more receipts than they had gold reserve to back it up and this would often end in situations

whereby depositors would all want to withdraw their money e.g.

they heard a rumour that the goldsmith was using their gold deposits to finance their lavish lifestyle.

This situation would often leave goldsmith bankrupted crashing the whole system.

In the modern days we have digitized this agreement. Today this agreement is called debt

For many years’ banks have been trying to pursue policymakers to allow them to create money digitally.

Banks highlighted the potential growth this might have for the future until they eventually pursued policymakers to create digital money.

Private Banking :Banking Through the Ages Part 2

Obtaining a banking license means a financial company adheres to strict government regulations.

Only licensed institutions can be designated as banks.

To earn this license, a company must meet a comprehensive list of requirements, such as maintaining financial reserves and safeguarding data systems.

Therefore, when an institution is granted a banking license, it is authorized to issue loans and accept deposits. Let’s start by examining deposits.

What significance does our deposit hold for a bank?

Many people aren’t aware that once you deposit money into a bank, you’re no longer the legal owner of that money; it becomes the bank’s money.

“What do you mean I’m no longer the legal owner of my money?” you might ask. Well, allow me to explain.

Whenever you deposit money into a bank, that amount appears on the bank’s financial statement in the liability column, meaning the bank owes you that money.

In other words, the bank owes you money that you can legally claim back anytime.

However, banks can legally loan out 90% of your money and keep 10% in reserves.

For example, if Mr. Walker goes to ABC Bank and deposits $100, ABC Bank then takes $10 (10%)

and puts it in their reserves and loans out his $90 (90%) with interest to their other client, Jake.

Jake then takes the $90 and pays off his mechanic for fixing his car.

Then Jake’s mechanic goes to ABC Bank and deposits the $90,

and the cycle would restart again.

This is known as fractional reserve banking. Basically, there was $190 in money circulation, and the bank had only $19 in their reserve.

Today, we see this scenario in large volumes because the world is run by debt. The economy is driven by the backbone of debt.

Now allow me to break down the process step-by-step to ensure clarity:

Initial Steps:

- Mr. Walker’s Deposit:

- Mr. Walker deposits $100 in ABC Bank.

- ABC Bank keeps $10 (10%) in reserve.

- ABC Bank loans out $90 (90%).

- Jake’s Transaction:

- Jake receives a $90 loan from ABC Bank.

- Jake pays $90 to his mechanic.

- Mechanic deposits $90 in ABC Bank.

- ABC Bank keeps $9 (10%) in reserve.

- ABC Bank loans out $81 (90%).

Total Money and Reserves:

- After Mr. Walker’s Deposit:

- Total Money Deposited: $100

- Money Loaned Out: $90

- Reserves Held: $10

- After Mechanic’s Deposit:

- Total Money Deposited: $100 (Mr. Walker) + $90 (Mechanic) = $190

- Money Loaned Out: $90 (Jake) + $81 (loaned out from Mechanic’s deposit) = $171

- Reserves Held: $10 (from Mr. Walker) + $9 (from Mechanic) = $19

Breakdown of Circulation:

- Initial Deposit (Mr. Walker): $100

- Reserves: $10

- Loaned Out: $90

- First Cycle (Jake’s Payment): $90

- Mechanic’s Deposit: $90

- Reserves: $9

- Loaned Out: $81

Verification of Money in Circulation:

- Initial Money in Circulation:

- Mr. Walker’s $100 deposit is part of the money supply.

- Jake has $90 in circulation after receiving the loan.

- Mechanic’s Deposit and New Loan:

- Mechanic has deposited $90, which is now part of the bank’s deposits.

- ABC Bank loans out $81 from the mechanic’s deposit.

Summary:

- The total money in circulation increases as loans are made and deposited back into the bank.

- After the initial deposit and first cycle:

- Money Supply: $100 (initial deposit) + $90 (loan to Jake) = $190

- Reserves Held by Bank: $19 (total reserves from initial and mechanic deposits)

Conclusion: Banking Through the Ages part 2

The process of fractional reserve banking indeed leads to a multiplied effect on the money supply while maintaining the required reserves at each step.

This scenario demonstrates how the money supply expands through repeated lending and depositing,

which is a fundamental aspect of how modern banking operates.

Banks today operate in an environment where there are policies in place to prevent them from becoming insolvent and collapsing the global system.

For many years, when too many depositors demanded their deposits back but the banks didn’t have enough reserves to service that outflow of liquidity,

unfortunately, the bank would have to file for bankruptcy and everybody would lose.

In the modern day, steps have been implemented to prevent bank runs like the establishment of Central banks.

They act as lenders of last resort because they have the muscle to inject liquidity directly into banks.

By doing so, they can stabilize the banking system given that there was perhaps a run on the bank

because people heard rumours or news that ABC Bank, for example, is going through financial instability.

My next article will focus on the 2008 crisis and the breakdown of central banks

[…] and discover how these financial principles affect your daily life. Click here to continue the journey! […]