Welcome back to the Strategic Trading Academy! In today’s lesson, we’ll focus on how to master the head and shoulders pattern. Previously, we covered trading the M and W patterns.

Why It Is Important to Understand the Basics of Patterns

Understanding the basics of patterns is crucial because it lays the foundation for successfully trading our strategies.

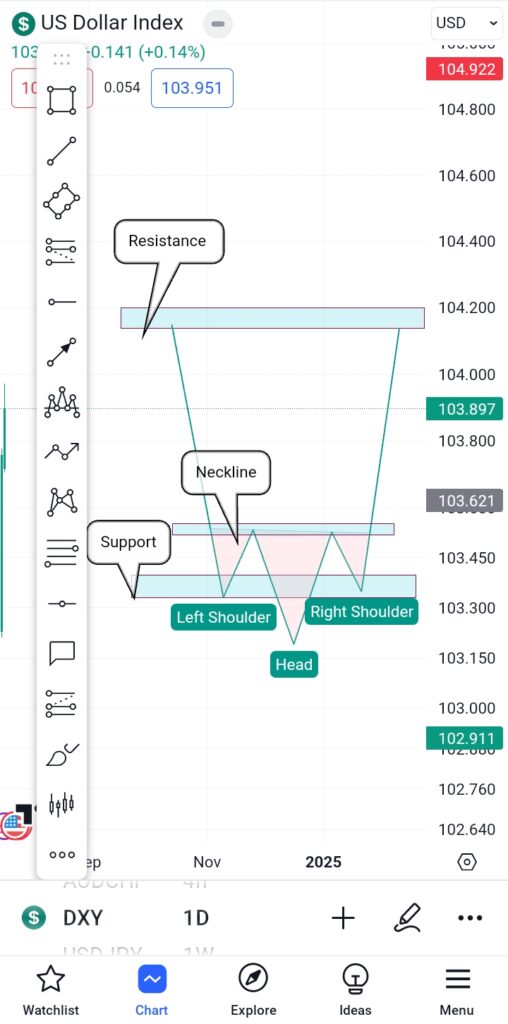

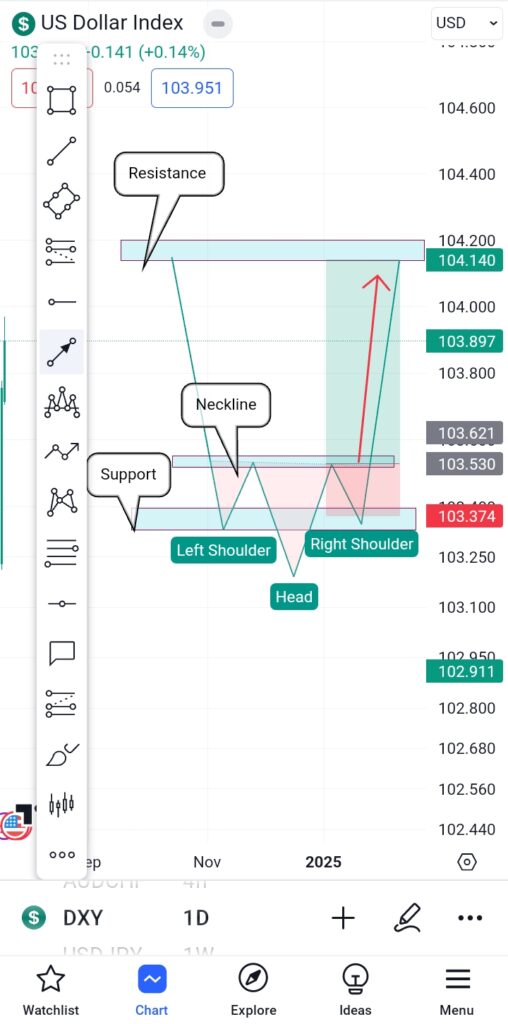

Inverted Head and Shoulders

To master the head and shoulders pattern, we must first recognize its appearance

on both support and resistance levels, acting as a reversal pattern.

An inverted head and shoulders pattern appears at a support trend, key level, or zone.

If this pattern appears elsewhere, it could be a trap set by market makers.

As I often emphasize on my YouTube channel, our Funds and Galore community focuses on high-probability setups

to gain an edge over the market and maintain consistency and profitability in the long run.

How to Capitalize on an Inverted Head and Shoulders Pattern:

To capitalize on an inverted head and shoulders pattern,

patience is vital. Allow the pattern to form in the support area. The sequence is as follows:

- The market drops to the support area, forming the left shoulder.

- Prices drop slightly lower, creating the head.

- The right shoulder forms at the same level as the left shoulder.

This confirmation indicates that the market has created our bullish

inverted head and shoulders pattern, signalling high-probability buying opportunities.

To master this pattern, it is essential to backtest and understand these setups thoroughly,

ensuring you can capitalize on these high-probability opportunities.

How Do You Know When to Enter an Inverted Head and Shoulders Pattern?

A practical lesson will be available; to access it,

all you need to do is click the link provided in this blog post.

The question now is; how do we know when to place our entries?

The best way to approach this is by placing your entries after the break and retest

from the neckline of the head and shoulders pattern.

After this confirmation, you can place your buy entries until the end of the pattern (take profit),

and you can also place your stop loss just below the neckline.

This will ensure you have an edge over the market by risking less than what you potentially stand to make. Click here to access the practical lesson.

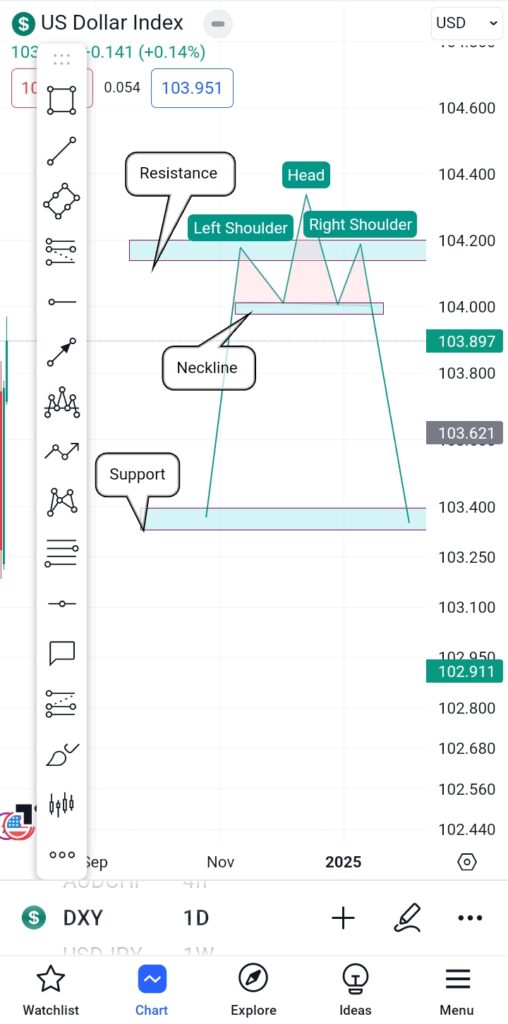

Master the Head and Shoulders Pattern on the Resistance Area: Head and Shoulders Pattern

To master a resistant head and shoulders pattern, one should be aware that these setups

should only be traded on a resistance trend, key level, or zone.

If this pattern appears elsewhere, it could be a trap set by market makers.

As I often emphasize on my YouTube channel, our Funds and Galore community focuses on high-probability

setups to gain an edge over the market and maintain consistency and profitability in the long run.

How to Capitalize on a Head and Shoulders Pattern (Resistance Area): Unlock the Secrets to Profitable Trading!

To capitalize on a head and shoulders pattern that appears in the resistance area,

as I previously said, patience is vital.

Allow the pattern to form in the resistance area. The sequence is as follows:

- The market pushes up to the resistance area, forming the left shoulder.

- Prices then push further up above our left shoulder, creating the head.

- The right shoulder forms at the same level as the left shoulder.

This confirmation indicates that the market has created our bearish

head and shoulders pattern, signalling high-probability selling opportunities.

To master this pattern, it is essential to backtest and understand these setups thoroughly,

ensuring you can capitalize on these high-probability opportunities.

How Do You Know When to Enter a Head and Shoulders Pattern?

A practical lesson will be available; to access it, all you need to do is click the link provided in this blog post.

The question now is; how do we know when to place our entries?

The best way to approach this is by placing your entries after the break and retest

from the neckline of the head and shoulders pattern.

After this confirmation, you can place your sell entries until the end of the pattern (take profit),

and you can also place your stop loss just above the neckline.

This will ensure you have an edge over the market by risking less than what you potentially stand to make. Click here to access the practical lesson.

Conclusion: Master the Head and Shoulders Pattern: Unlock the Secrets to Profitable Trading!

In conclusion, mastering the head and shoulders pattern is essential for profitable trading.

Understanding the basics of patterns provides the foundation for successful strategies.

Recognizing the head and shoulders pattern on support and resistance levels

helps identify high-probability setups. For an inverted head and shoulders pattern at support,

wait for the market to form the left shoulder, head, and right shoulder, signalling a buying opportunity.

Conversely, at resistance, a head and shoulders pattern signals a selling opportunity.

Patience and thorough backtesting are crucial for capitalizing on these patterns.

To know when to enter, look for a break and retest from the neckline, ensuring you risk less than your potential profit.

For practical lessons, follow the links provided in the blog post. Happy trading!