The Market: A Challenger Designed to Test You

Welcome back to part 2 of Perfecting the Art of Trading Psychology. Today, we continue our journey towards mastering the world of retail trading.

Consider this: In South Africa, approximately 4,000 individuals apply for aircrew training each year. Out of this sizable pool,

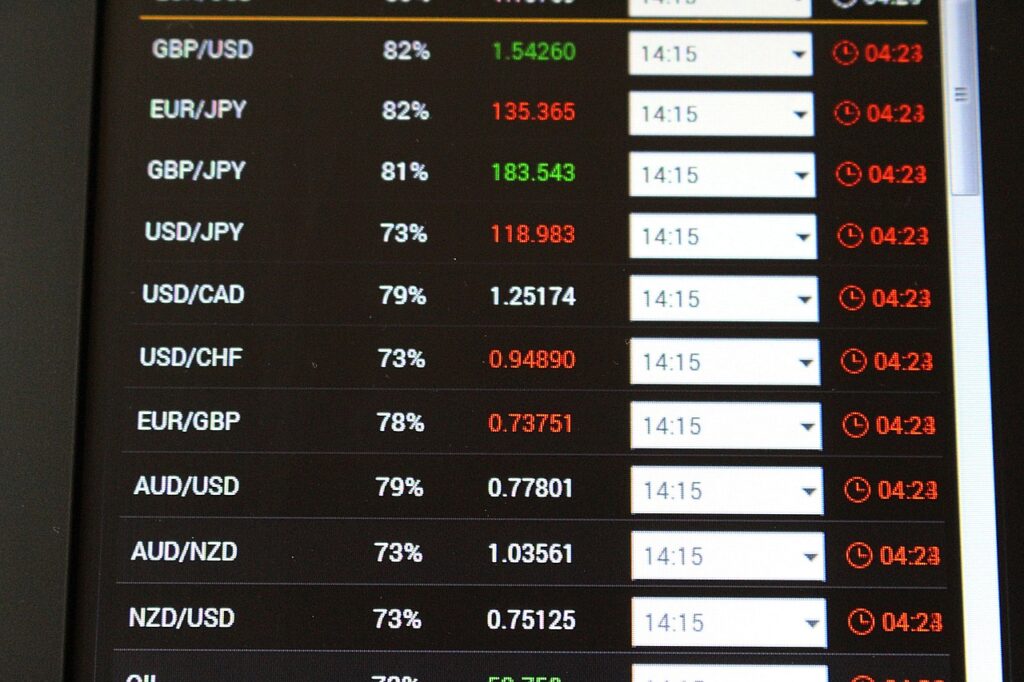

only about 30 will ultimately be selected. Interestingly, the world of Forex trading shares a similar narrative .

Did you know that a staggering 90% of all retail traders fail to turn a profit? That leaves only a mere 10% who manage to succeed.

Your objective? To become part of that elusive 10%. It’s challenging, but possible.

To thrive in the world of Forex trading, you must believe in your ability to prosper and adopt a mind-set of unwavering determination.

Remember, in Forex, it’s you against the market – always keep that in mind.

Importance of Demo Account: Perfecting the Art of Trading Psychology

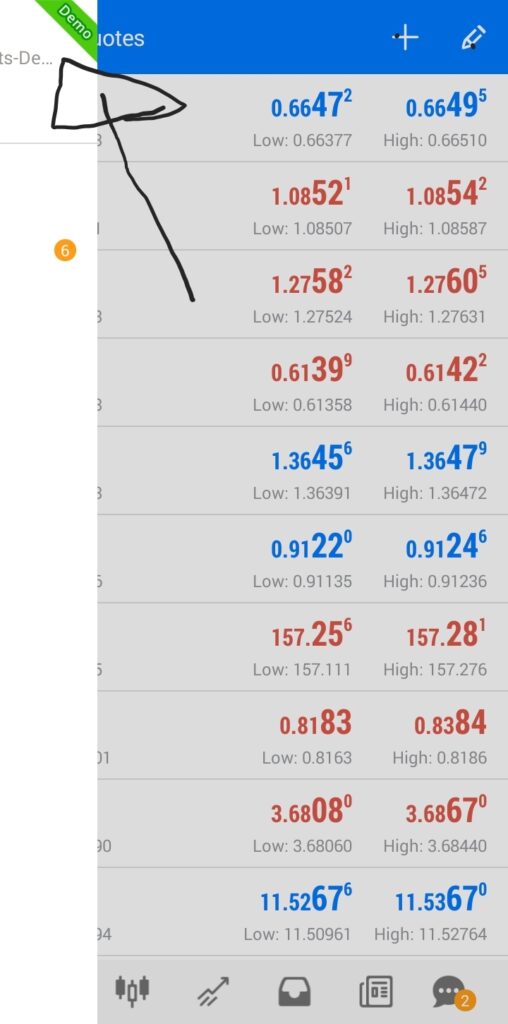

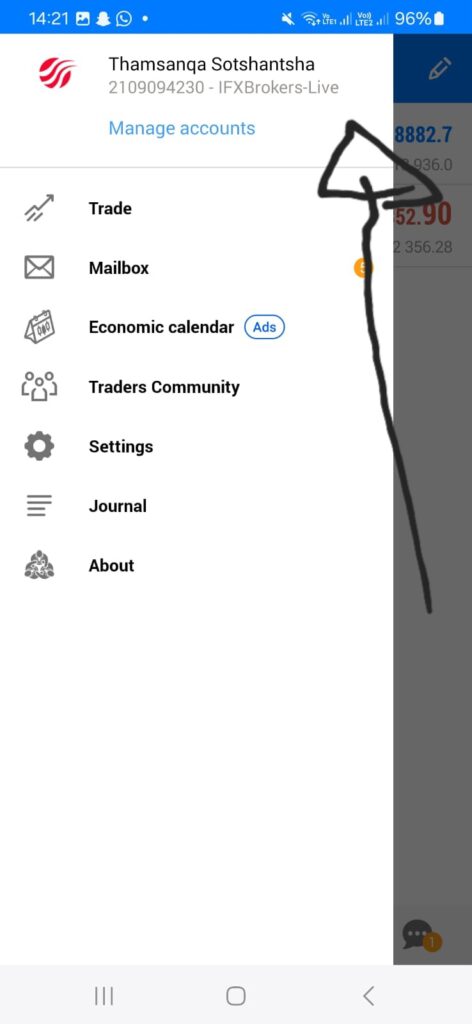

A demo account is provided to you by the broker of your choice. This account simulates the market in real-time, allowing you to practice trading without financial risk.

Additionally, brokers also offer real/live accounts, which involve actual funds and real market conditions.

Remember in my previous article “Perfecting the Art of Trading Psychology” I stated that my excitement impatience (of money money) got the best of me?

Well if you have not checked it out CLICK HERE! Before continuing.

Why I Encourage You to Start Trading Demo Accounts Only: Art of Trading Psychology

When I first started trading in 2020, I didn’t have anyone to educate me about the importance of using a demo account.

So, weeks before I had my first call with Ethan, I began trading on a demo account.

At that time, I had no understanding of technical or fundamental analysis. All I knew was to buy when the market was low and sell when it was high.

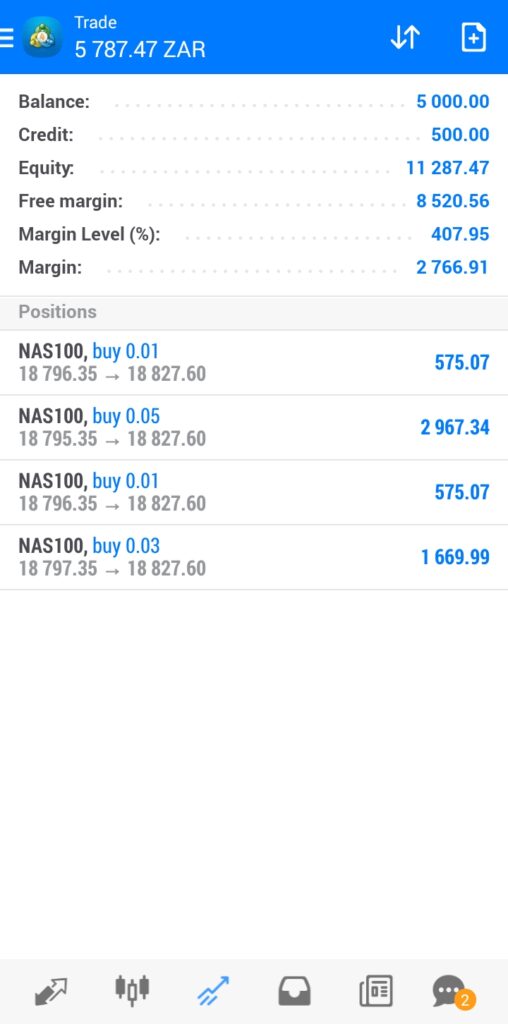

I would create a $100,000 demo account, not realizing the importance of setting a realistic account size.

For example, I would trade the EUR/USD currency pair with a large lot size (5.00 lots). Since it was a demo account,

I wasn’t trading with real money and emotions weren’t involved. I would often forget about my trades, only to remember days later and find my account in significant profit.

I did this without any risk management strategy.

This is a common experience for many new forex traders. When you start with a demo account,

especially without proper guidance, it’s easy to make profits. However, the real challenge begins when you transition to trading with a real account.

As humans, we naturally feel euphoria when we gain money and sadness when we lose it, especially when it happens without our control.

This emotional response can significantly impact trading decisions. Trust me, it’s a common experience.

Even seasoned traders have gone through similar stages in their trading journey.

Remember, the goal is to develop the right skills and mind set to transition smoothly from demo trading to live trading.

With practice and proper guidance, you can turn your demo trading experience into a powerful tool for success in the forex market.

Turn Your Demo Account into a Profitable Machine with the Right Skills

Before funding a real account, it’s essential to have a fool proof strategy.

But what exactly is a fool proof strategy?

A fool proof strategy is one that has been thoroughly tested and proven to work over time.

Think of it like a pharmaceutical scientist testing a new drug: the drug must undergo numerous testing to ensure it’s safe for consumers.

Similarly, a forex or stock trader needs to test their strategy to ensure it works in the long term before using it with a real account.

I recommend starting with a demo account primarily so you can focus on mastering the strategy I’m going to teach you, rather than on making money.

When you focus on the skill, the money will eventually follow. However, if you focus solely on the money, it’s unlikely to come your way.

Once we’ve covered the practical curriculum (technical analysis), we can create demo accounts and start practicing to find the trading style that best suits your personality.

How to master your Fears? Perfecting the Art of Psychology

The emotion of fear is very common in forex or stock trading

and it is one of the main reasons a lot of trader’s fail to be profitable traders. Fear often presents itself in two stages:

Fear of losing your winning trade

In 2020, a month or two after I had blown my first real account, I found myself at my grandma’s house during the holiday season.

It was high school break, and I was visiting her and my cousins.

At that time, I was trying to grow my remaining account balance of $37.99,

hoping to recover my initial deposit of $270.06 USD The market had taught me a valuable lesson, and my fear of losing the rest of my account was at an all-time high.

I was somewhat familiar with a few key price strategies, like trends and the importance of using stop-loss and take-profit orders.

However, my trading skills were nowhere near what they are today. On my first trade, relying solely on trend lines,

the market moved in my direction by just a few pips. Instead of excitement, I was filled with fear.

The reason for this fear was the lingering memory of a USA30 trade that had caused me to lose $978 in profit within minutes.

This memory clung to my mind like Venom clings to Eddie Brock in the Marvel Movie Venom.

The fear was so intense that I could spend over two hours staring at the chart without even realizing it.

Today, I can spend a total of one hour in the market per day because I know exactly what I’m looking for in the market.

Another reason for my fear was that I did not set a stop-loss order, fearing that the market would retrace, stop me out, and then move in my desired direction.

I only set a take-profit order. Trading without a stop-loss is basically gambling; it’s not professional trading.

This behaviour heightens fear levels because, whether you realize it consciously or not, your subconscious is well aware that you could lose all your investments at any moment.

That’s why many inexperienced traders get glued to the charts all day like chart zombies, leading to unnecessary trades that eventually blow their accounts.

Fear of Losing a trade

By 2021, my trading style was starting to take shape. I had studied numerous price action strategies, such as trends, zones,

support and resistance, and had mastered the risk/reward ratio. After funding my fifth account (yes, I’ve blown many accounts),

I convinced myself to test trading with a stop-loss.

I funded my fifth live account, sacrificing new clothes and other expenses to stay committed to becoming a profitable trader.

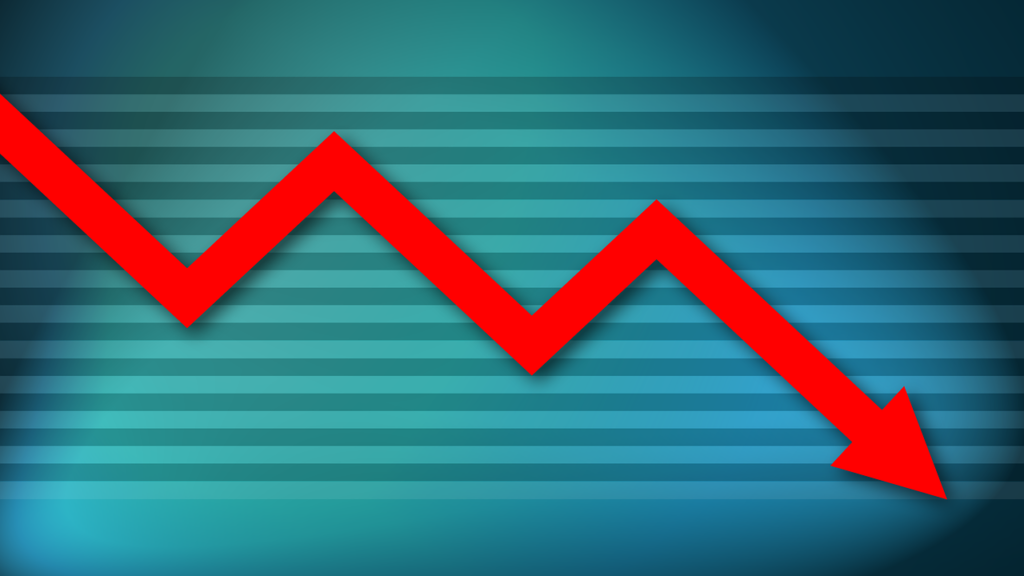

Just as I was on the right path, I faced a new emotion: the fear of a pending loss.

This fear arises when you don’t fully trust your trading strategy.

The market often moves in the opposite direction before heading toward your target, testing your confidence in your strategy.

Here’s what happened to me: I caught a beautiful sell signal, but instead of the market falling, it pushed up, nearing my stop-loss.

Instead of letting the market play out, I closed the trade early, resulting in a loss. Ironically, after I closed my position, the market eventually sold off.

I felt so defeated that I even considered quitting trading altogether.

To manage this emotion, you must trust your strategy and let your trades play out.

Only by trusting in your abilities can you identify your mistakes and determine which setups work best for you.

This is why I emphasize the importance of practicing with a demo account. It allows you to focus solely

on mastering your skills, which better prepares you to handle the emotional aspects of trading.

End of Part 2: Perfecting the Art of Trading Psychology Part 2

Trading can be an emotional rollercoaster, especially when you’re just starting. It’s crucial to begin with a demo account

to build your skills without the pressure of real money on the line. By mastering a fool proof strategy and learning to manage your emotions,

you can transition to a live account with greater confidence and discipline.

Remember, the key to successful trading is not just about making money

but about developing a consistent and reliable strategy. Trust in your abilities, stay committed to your learning process, and don’t let fear dictate your actions.